Early voting for the Williamson County referendum to raise the sales tax began Wednesday and will run through Thursday, February 1.

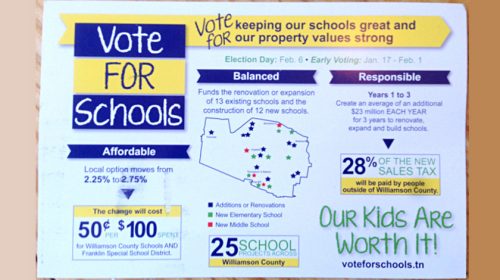

On the ballot is a proposal that would increase the county’s contribution to the state sales tax by a hefty 22 percent resulting is a new tax rate of 2.75 percent:

Shall Resolution No. 11-17-15, passed by the Williamson County Commission on November 13, 2017 published in the Tennessean, Williamson A.M., newspapers of general circulations, and as authorized by and be levied and collected pursuant to the Retailer’s Sales Tax Act and the 1963 Local Option Revenue Act under Title 67, chapter 6, Tennessee Code Annotated, which will increase the local option sales and use tax rate from 2.25% to 2.75% become operative?

County officials and some business leaders support the measure and say the “modest” hike will generate about $60 million over three years. The money is slated to retire outstanding debt from new school construction.

The Tennessee Star obtained two separate mailers, one sent by the National Association of Realtors Issues Committee. The other was by group calling itself “Citizens for School Funding” with the web address: voteforschools.tn A quick lookup shows Matt Largen listed as the group’s Treasurer. Largen is also the president and CEO of the Williamson County Chamber of Commerce, Williamson, Inc. which is in part, taxpayer-funded.

This is not the first time Mr. Largen has sought to influence the education system. In 2016, the Tennessee Watchdog reported the Chamber CEO was alleged to have targeted school board members who “too often fail to go along and get along:”

[County Commissioner Todd] Kaestner says the chamber is using taxpayer-funded resources to threaten school board members and, perhaps, a few county commissioners.

“This is crony capitalism at its worst,” said Kaestner, who will introduce a resolution during Monday’s scheduled commission meeting to keep Williamson Inc. from getting more county money.

“I don’t think we ought to fund them with any taxpayer money if they’re going to mutate into a political organization. Their CEO is taking a leading role in fundraising, and the chamber will appoint the PAC’s board of directors every year. If they want to engage in political activity then they ought to go ahead and give up their taxpayer-funded subsidy.”

Williamson Inc., which is responsible for promoting economic development, agreed to get off the county’s dime years ago, Kaestner said.

The chamber’s budget this year is $900,000, and just a third of that was from the county, Kaestner said.

However, not everyone is convinced the tax increase is necessary. Williamson County GOP Chair Debbie Deaver said in December, when the county successfully voted for the referendum:

Raising the sales tax is a Band-Aid and is not a real solution nor does it address the grown-up conversation we need to have in the County about who pays for growth long term. Suggesting you have a tax revenue problem then spending $140,000 on a special election almost 90 days prior to a general election seems counter-intuitive and an example of why Republicans typically oppose tax increases.

Voters can cast their ballot in-person through February 1 at the Williamson County Election Commission Office at 1320 W. Main Street in Franklin from 8am to 4:30pm Monday through Friday, and from 8am to noon Saturdays.

In the last, short week of early voting beginning on January 29, however, the Election Commission Office will stay open an extra hour-and-a-half until 6pm.

The County has a half-dozen satellite voting locations that are either open, or will be opening soon, to accept early voting ballots.

Election Day is Tuesday, February 6 where polling places will be open from 7am to 7pm.

The Election Commission notes that Fairview residents are “not entitled to vote on this measure” due to the previous passage of a sales tax increase back in 2004, which put them at the maximum tax rate allowed by the state of Tennessee.

It has to be good because it is “for the children”. Where have I heard that lie before? Those wanting more of our hard earned money will never be satisfied. There is always another “got to have” pet project to raise taxes. Hopefully the citizens will tell the bureaucrats NO!. Look down the road a bit – if Mayor Berry gets her tax plan passed for her toy train plan will the people of Williamson County vote to raise their taxes again to join in on the mayor’s folly? Where does it end?